API Description

The Global and Domestic Minimum Group Entity Tax Return API enables software users (a Designated Local Entity (DLE), a tax agent or a Group Entity) to lodge a Combined Global and Domestic Minimum Tax Return (CGDMTR) on behalf of one or multiple entities within their multinational enterprise (MNE) group. This API is to support the digital lodgment of tax returns for entities that are subject to Australia's implementation of the OECD's Global Anti-Base Erosion (GloBE) Rules. It facilitates the reporting for multiple group entities, with the API being called once per entity, for the following obligations:

Foreign lodgment notification

Notification that must be given to the Commissioner of Taxation by either each Australian Group Entity itself or the nominated DLE when the GloBE Information Return (GIR) is not lodged locally with the ATO.

Australian IIR/UTPR Tax Return (AIUTR)

Australian domestic tax return for the global minimum tax that enables the triggering of Australia's domestic assessment and pay provisions.

Australian DMT Tax Return (DMTR)

Australian domestic tax return for the domestic minimum tax that enables the triggering of Australia's domestic assessment and pay provisions.

Effective Dates

- The foreign lodgment notification, Australian Income Inclusion Rule Top-up Tax Amount and Australian Domestic Top-up Tax Amount apply to fiscal years stating on or after 1 January 2024.

- The Australian Under-Taxed Profits Rule Top-up Tax Amount applies to fiscal years starting on or after 1 January 2025.

Use Cases

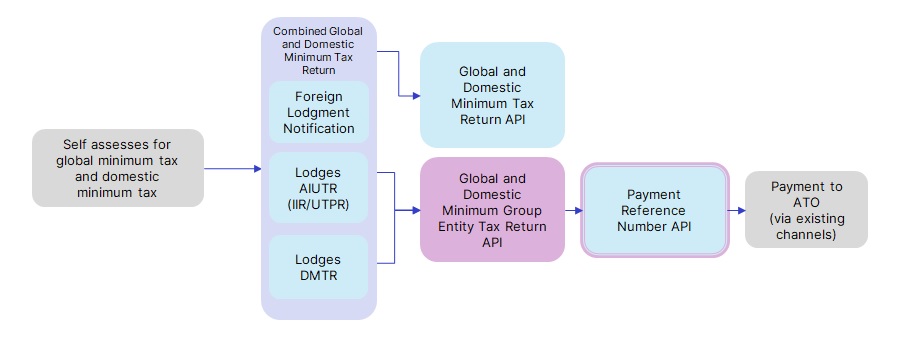

Use Case Flow: Global and Domestic Minimum Group Entity Tax Return API

Self-Assessment

The Group Entities of an MNE group self-assess their obligations to report under the following components:

- Foreign lodgment notification

- Australian IIR/UTPR Tax Return (AIUTR)

- Australian DMT Tax Return (DMTR)

Lodgment of the Global and Domestic Minimum Group Entity Tax Return API(s)

- The Global and Domestic Minimum Group Entity Tax Return API is submitted for each Group Entity that is included in the CGDMTR, covering the foreign notification, AIUTR and DMTR obligations.

- A CGDMTR is also required to be lodged via the Global and Domestic Minimum Tax Return API, covering the foreign lodgment notification, AIUTR and DMTR obligations for one or more entities in the MNE group.

ATO Processing

- The ATO receives the CGDMTR which is used to post tax liabilities to each relevant Group Entity's account.

Lodgment Confirmation and Payment

- A lodgment confirmation is returned to the lodger, with a Payment Reference Number (PRN) for each Group Entity with liabilities greater than $0.

- The Group Entity makes a payment to the ATO through existing payment channels.

Scopes

ato.apGlobalDomesticMinimumTax

Rate Limit

Not Applicable

Response Messages

For response messages specific to the Global and Domestic Minimum Group Entity Tax Return API, see Global and Domestic Minimum Group Entity Tax Return API - response messages.

For response messages common to all the APIs available in our API Catalogue, see Common response messages.

Release Notes

API Version: 0.1.5

- Release date: 21 Nov 2025 (Sandbox)

- Description: Initial release for testing. The following have been implemented in this release:

- API description and use case have been updated to standardise the use of terminology like lodging entity/ies instead of taxpayer/s. Group Entity/ies instead of constituent entity/ies.

- Global and Domestic Minimum Group Entity Tax Return API has been updated due to changes in OAS schema and to include validation rules.

- Common response messages and API specific response messages with trouble-shooting information have been added.

Go back to Global and Domestic Minimum Tax