Using this API product

Description

Australia has implemented the Global Anti-Base Erosion Model Rules by introducing a global and domestic minimum tax.

This API product allows lodging entities and their authorised tax agents to lodge, via their software products, directly to the ATO for one or multiple entities (up to 300 entities in one lodgment) within their MNE group, covering the following obligations in the Combined Global and Domestic Minimum Tax Return (CGDMTR):

Foreign lodgment notification

Notification that must be given to the Commissioner of Taxation by either each Australian Group Entity itself or the nominated Designated Local Entity (DLE) when the GloBE Information Return (GIR) is not lodged locally with the ATO.

- Australian IIR/UTPR Tax Return (AIUTR)

Australian domestic tax return for the global minimum tax that enables the triggering of Australia's domestic assessment and pay provisions.

- Australian DMT Tax Return (DMTR)

Australian domestic tax return for the domestic minimum tax that enables the triggering of Australia's domestic assessment and pay provisions.

For further information go to Lodging, paying and other obligations for Pillar Two | Australian Taxation Office

Lodging entities or their tax agents can submit an original lodgment or an amendment via this API product. Amendments can only be lodged by the entity that submitted the original return, to amend previously submitted information.

In addition, they will receive a lodgment confirmation response, including payment reference numbers (PRNs) for entities that have liabilities to pay.

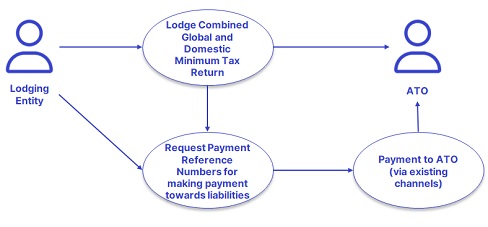

Business usage and process flow

The Global and Domestic Minimum Tax Product provides a suite of functionality that allows the adoption, design and lodgment of the CGDMTR. The Global and Domestic Minimum Tax Product enables this by providing three APIs that can be used to lodge and/or amend the CGDMTR and provide PRNs for making payments towards liabilities reported.

The APIs that are part of the API Product to deliver this functionality are provided below:

- Global and Domestic Minimum Tax Return API

- Global and Domestic Minimum Group Entity Tax Return API

- Payment Reference Number API

Lodging Entity

- The lodging entity or their authorised tax agent, will be able to lodge the CGDMTR via the use of the above mentioned Global and Domestic Minimum Tax Return API.

- Tax liabilities for Group Entities under the MNE group may be reported in the CGDMTR when lodged to the ATO.

- Upon successful response from the Global and Domestic Minimum Tax Return API the ATO will receive the lodged CGDMTR.

- The Global and Domestic Minimum Group Entity Tax Return API allows the lodging entity to report IIR, UTPR, and DMT tax liabilities for a Group Entity within their MNE group. The lodging entity will also be able to retrieve PRNs directly for the Group Entity that has a liability greater than $0, using the above mentioned Payment Reference Number API.

ATO

- ATO will return a lodgment confirmation or any errors that may happen during the lodgment of the CGDMTR. A PRN will be returned when there is a liability for a Group Entity.

Instructions to Digital Software Developers for lodgments of original and amendments using ATO APIs.

- To report IIR, UTPR, and DMT tax liabilities for a Group Entity within their MNE group using the Global and Domestic Minimum Group Entity Tax Return API, ensure you use the transaction ID of the successful lodgment of the CGDMTR only, which is available in the Global and Domestic Minimum Tax Return API response.

- Selecting Transaction Type: ORIGINAL or AMENDMENT

- Use ORIGINAL for the first lodgment for a reporting period.

- Use AMENDMENT for any changes after a successful submission of an original lodgment, including updates to lodging entity or group entity details. A full set of the Combined Global and Domestic Minimum Tax Return and Group entity tax return(s) must be re-submitted as AMENDMENT. - When a submission encounters errors, the re-submission transaction type will be dependent on the error code.

| Lodgement Type | Error Code | Action | |

|---|---|---|---|

| Original | Error listed in common response message or Error code between GDMT-00000 and GDMT-99999 |

Resolve the error and re-submit as ORIGINAL. | |

| Original | Error code between GDMT.EM00000 and GDMT.EM99999 | The lodgment was received but not processed due to these errors. When the error is resolved, re-submit as AMENDMENT. Attempting to re-submit as ORIGINAL in these cases will return error GDMT.EM778. | |

| Amendment | Any Error | When the error is resolved, re-submit as AMENDMENT and ensure you use the transaction ID of the successful lodgement of the CGDMTR in the Group entity tax return(s). | |

Original lodgment:

- The first year of lodgment, in the absence of Global and Domestic Minimum Tax account under the client, only lodgment for an annual period should be accepted. If the reporting period is greater or less than 12 months, an error and a message to contact ATO to configure the period must be provided.

- In the first year or subsequent years of lodgment, if the Global and Domestic Minimum Tax account is present, the period entered must be verified with the periods available under the lodging entity’s Global and Domestic Minimum Tax account and Global and Domestic Minimum Tax Reporting role using the SBR Lodgment List (LDG) service by calling the service before lodging. If the period entered is not available, an error and a message to contact the ATO to configure the required period must be provided.

- For a DLE lodgment ensure that details of all the Group Entities the DLE represents are provided in this return. It will not be possible to add or remove Group Entities as part of an amendment.

- The postal address of the lodging entity provided will be added or updated on the Global and Domestic Minimum Tax account of the lodging entity.

- The lodging entity details must be pre-populated as the first Group Entity on the lodgment (Group Entity tax return).

- Ultimate Parent Entity (UPE) details must be provided if the UPE is different to the lodging entity. If they are the same, the UPE details will need to be populated with the lodging entity details as applicable.

- Designated Filing Entity (DFE) details are needed only when the GIR is lodged by DFE in a foreign jurisdiction.

Amendment to prior lodgment:

You cannot amend the following information that was provided in the original tax return:

- Capacity of lodging entity, that is, switching from a Group Entity to DLE or DLE to Group Entity

- Adding or removing a Group Entity

- Identifiers of the lodging entity including TFN/ABN/ARN/TIN and name

- Identifiers of Group Entities including TFN/ABN/ARN, name and business address

- The reporting period of the return

You can amend all other information including (not exhaustive):

- Authorised contact details of the lodging entity

- Entity type of lodging entity, e.g. from Trust to Company

- Entity type of Group Entities, e,g. from Trust to Company

- Where applicable, associate entity details of the lodging entity

- Where applicable, associate entity details of the Group Entities

- Top-up-tax amounts

The number of group entities on the amendment must match the number of group entities on the original.

All validations applicable on the original are applicable on the amendment.

Authentication

See Client Authentication | ATO API Portal

Authorisation

The Global and Domestic Minimum Tax product can be used by a lodging entity or intermediary on behalf of the lodging entity. The intermediary must have the appropriate authorisation for the interaction being performed on behalf of the lodging entity recorded in ATO systems.

Lodging Entity Authorisation

- The lodging entity identifying information being passed to the API must not be a sole trader

Intermediary - Registered Tax Agent Authorisation

- Registered tax agents must be appropriately linked to the lodging entity at an account or client level to use the service on behalf of the lodging entity

For more information around how to ensure everything is setup correctly for authorisation calls to the APIs refer to access manager authorisation.

End User

Lodging entity: A Group Entity lodging on a standalone basis, or a DLE - a centralised filing entity on behalf of all Group Entities. Group Entities include Joint Ventures and any entities that are within scope of Global and Domestic Minimum Tax.

Intermediary - registered tax agent: Authorised to act on behalf of a Group Entity or DLE.

Scopes

ato.apGlobalDomesticMinimumTax

Risk Rating

4 - High Risk

For more information, see API risk rating.

Rate Limit

Not Applicable

Test Scenarios

The Global and Domestic Minimum Tax Test Scenarios are provided in the sandbox environment to guide you in the development of your application software.

Testing of the mandatory test scenarios is a mandatory requirement before production access is granted.

Production Requirements

Before you can request production access for this API Product, you must meet the requirements for production access.

Constituent APIs

API List

Global and Domestic Minimum Tax Return API

API specification

Global and Domestic Minimum Group Entity Tax Return API

API specification

Payment Reference Number API

API specification

Release notes

26 February 2026

Update to content in Business usage and process flow for the part relating to the instructions to Digital Software Developers

- Updated the instructions to provide clear guidance on when a lodgment must be submitted as an ORIGINAL or AMENDMENT transaction type.

- Updated to provide clarity on the instruction to use transaction ID of the successful CGDMTR lodgment in Group entity tax return(s).

- Added a note clarifying that the transaction IDs shown in the test scenarios are pre‑defined for sandbox testing only. In production, a new transaction ID is generated for every API request.

11 February 2026

Update to content in Business usage and process flow for the part relating to the instructions to Digital Software Developers

- Updated instructions to Digital Software Developers to provide the transaction ID of the most recent successful lodgement of the CGDMTR, to report IIR, UTPR, and DMT tax liabilities for a Group Entity using the Global and Domestic Minimum Group Entity Tax Return API.

Update to Response Messages for the removal of 6 API specific response messages for Global and Domestic Minimum Group Entity Tax Return API.

- GDMT.EM91532

- GDMT.EM778

- GDMT.EM777

- GDMT.EM61012

- GDMT.EM61081

- GDMT.EMxxxxx

21 November 2025

Initial Release (Sandbox)

Product description and Business usage and process flow

- Updated name of the APIs:

- Global and Domestic Minimum Constituent Entity Tax Return API to Global and Domestic Minimum Group Entity Tax Return API

- PRN Retrieval API to Payment Reference Number API

- Provided instructions and guidance for submitting new lodgment and amendment to prior lodgment using the ATO APIs

- Standardised the use of terminology like lodging entity/ies instead of taxpayer/s, Group Entity/ies instead of constituent entity/ies

Test Scenarios

- Provided mandatory test scenarios which is a mandatory requirement before production access is granted.

- Provided recommended test scenarios for additional testing to ensure optimal user experience.

Response Messages

- Provided a list of common response messages and API specific response messages with trouble-shooting information.

Global and Domestic Minimum Tax Return API

- Open API Specification (OAS)

- Streamlined the API endpoint.

- Refined the request body schema structure, including change of object and field names.

- Added a new field transactionTypeCode to indicate if it is a new lodgment or an amendment.

- Changed declaration object in the request to simplify the declaration based on the capacity the tax return is submitted.

- Updated enumeration list for jurisdictionCountryCode and countryCode of all business and postal addresses to exclude the value "OT" (ie. Other).

- Changed the pattern for eight fields which are the following:

- lodgingEntityName

- associateEntityName (lodgingEntityAssociateDetails)

- groupEntityName

- associateEntityName (groupEntityAssociateDetails)

- ultimateParentEntityName

- designatedFilingEntityFullName

- agentFullName

- fullName (lodgingEntityAuthorisedContact)

Global and Domestic Minimum Group Entity Tax Return API

- Open API Specification (OAS)

- Streamlined the API endpoint.

- Refined the request body schema structure, including change of object and field names.

- Add a new field transactionTypeCode to indicate if it is a new lodgment or an amendment.

- Updated enumeration list for jurisdictionCountryCode and countryCode of all business and postal addresses to exclude the value "OT" (ie. Other).

- Changed the pattern for two fields which are the following:

- groupEntityName

- associateEntityName (groupEntityAssociateDetails)

Payment Reference Number API

- Initial release.

16 July 2025

Initial version published for consultation.