API Description

The Global and Domestic Minimum Tax Return API allows software users to lodge a Combined Global and Domestic Minimum Tax Return (CGDMTR) directly to the Australian Taxation Office (ATO) for one or multiple entities within their multinational enterprise (MNE) group. This API is to support the digital lodgment of tax returns for entities that are subject to Australia's implementation of the OECD's Global Anti-Base Erosion (GloBE) Rules. It facilitates the reporting of obligations under the following components:

- Foreign lodgment notification

Notification that must be given to the Commissioner of Taxation by either each Australian Group Entity itself or the nominated Designated Local Entity (DLE) when the GloBE Information Return (GIR) is not lodged locally with the ATO.

- Australian IIR/UTPR Tax Return (AIUTR)

Australian domestic tax return for the global minimum tax that enables the triggering of Australia's domestic assessment and pay provisions.

- Australian DMT Tax Return (DMTR)

Australian domestic tax return for the domestic minimum tax that enables the triggering of Australia's domestic assessment and pay provisions.

Effective Dates

- The foreign lodgment notification, Australian Income Inclusion Rule Top-up Tax Amount and Australian Domestic Top-up Tax Amount apply to fiscal years starting on or after 1 January 2024.

- The Australian Under-Taxed Profits Rule Top-up Tax Amount applies to fiscal years starting on or after 1 January 2025.

Use Cases

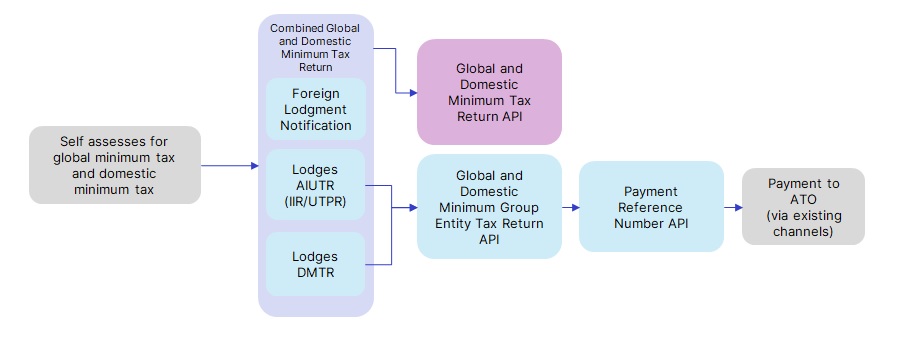

Use Case Flow: Global and Domestic Minimum Tax Return API

Self-Assessment

The MNE group entities self-assess their obligations to report under the following components:

- Foreign lodgment notification

- Australian IIR/UTPR Tax Return (AIUTR)

- Australian DMT Tax Return (DMTR)

Lodgment of the CGDMTR - Submitted by the Designated Local Entity (DLE)/Tax Agent or the Group Entity individually

A CGDMTR is submitted through the Global and Domestic Minimum Tax Return API covering the foreign lodgment notification, AIUTR and DMTR obligations for one or more entities (up to a maximum of 300 entities per lodgment) in the MNE group.

Guidance for Group Entities

groupEntities of the CGDMTR are repeating groups used to report group entities within the MNE group, including the lodging entity itself. Accordingly, Digital Service Providers (DSPs) should note that the first Group Entity listed in groupEntities typically corresponds to the lodging entity, whose details are completed in the lodgingEntity.

To support consistency and reduce manual data entry, DSPs are encouraged to implement pre-population logic that transfers relevant information from lodgingEntity into the appropriate parts of groupEntities for the first repeating group. This approach helps ensure data accuracy and alignment with the expected structure of the form.

ATO Processing

- The ATO receives the CGDMTR and issues a lodgment receipt.

- It also receives the associated group entity data (via a related API product), which is used to post tax liabilities to each relevant Group Entity's account.

Lodgment Confirmation and Payment

- A lodgment confirmation is returned to the lodger.

Scopes

ato.apGlobalDomesticMinimumTax

Rate Limit

Not Applicable

Response Messages

For response messages specific to the Global and Domestic Minimum Tax Return API, see Global and Domestic Minimum Tax Return API - response messages.

For response messages common to all the APIs available in our API Catalogue, see Common response messages.

Release Notes

API Version: 0.1.5

- Release date: 21 Nov 2025 (Sandbox)

- Description: Initial release for testing. The following have been implemented in this release:

- API description and use case have been updated to standardise the use of terminology like lodging entity/ies instead of taxpayer/s. Group Entity/ies instead of constituent entity/ies.

- Global and Domestic Minimum Tax Return API has been updated due to changes in OAS schema and to include validation rules.

- Common response messages and API specific response messages with trouble-shooting information have been added.

Go back to Global and Domestic Minimum Tax